Introduction

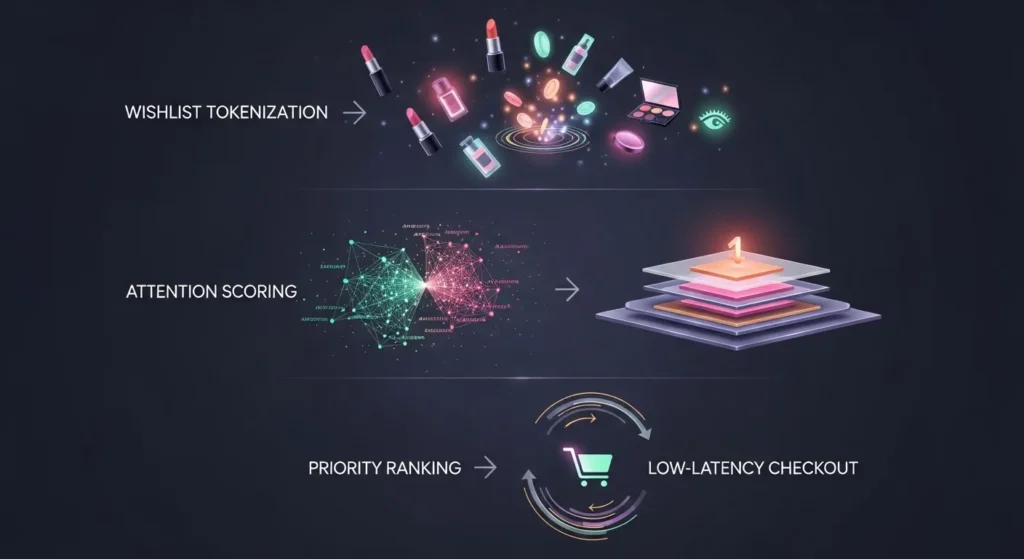

Black Friday at Sephora Behaves like a high-traffic sequence prediction problem: inputs (brand drops, GWPs, tiers, stock levels) change over time, and successful shoppers aim to optimize an output — maximal value within constraints (budget, shipping, returns, and time). In this guide I translate classic retail tactics into Natural Language Processing metaphors and practical heuristics so you can treat Cyber Week like a pipeline: ingest data (brand preview), tokenize your wishlist, compute priority scores with an “attention” mechanism, and execute purchases using a low-latency inference loop (fast checkout via app + saved payment).

What to expect: Dates & sale structure

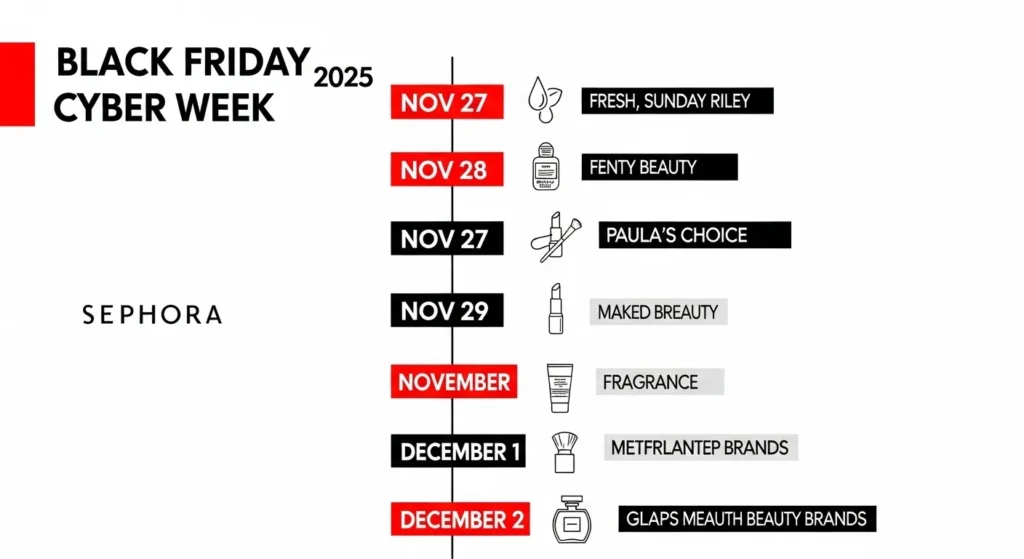

When is Sephora Black Friday & Cyber Week 2025?

Black Friday 2025: Friday, 28 November 2025. Sephora runs Cyber Week as a multi-day, staggered event, not a single inference step. Expect brand-day drops before, during, and after Nov 28 — Sephora’s Cyber Week preview is the canonical schedule (treat it as the ground truth labels for your shopping model).

How the sale is usually structured (high-level architecture)

- Brand-of-the-day drops (temporal segmentation): Each calendar day during Cyber Week often hosts specific brands with targeted discounts. These brand windows may be one day or multi-day. Think of them as time-bound softmax gates: items on that brand’s list receive a higher probability of discounting.

- Gifts-with-purchase (GWP) and spend thresholds (bundle features): Many offers include GWPs when a minimum spend threshold is exceeded. These are conditional features — only triggered when cart-level conditions are met.

- App & Beauty Insider perks (privileged tokens): Sephora’s loyalty tiers (Insider / VIB / Rouge) and app users frequently get early access or extra GWPs. These are privileged tokens that improve your expected value. If you’re not a member, the cost of joining is often outweighed by early-access alpha.

- Fine print & exclusions (regularization): Discounts may be constrained by exclusions (new launches, select SKUs) — always read the brand-day banner and product-level notes; treat them like constraints in your optimization objective.

Quick rules that shape your plan

- Treat Black Friday as a whole week (temporal context matters).

Sephora’s biggest reductions can appear before or after Friday. Map brand-day drops to your wishlist and horizon-plan accordingly. - Use the app + join Beauty Insider (reduce latency).

App notifications, saved payment methods, and Insider perks reduce checkout latency and increase your chance to secure high-value items. - Prioritize gift sets and high-ticket tools first (maximize absolute savings).

High-ticket hair tools and curated gift bundles usually produce the largest absolute discount in currency terms. A 20–30% reduction on a £250 tool saves more than 50% on a low-cost item in absolute terms; prioritize accordingly. - Read brand-day fine print (avoid poisoned data).

Some brands restrict promotions by category or exclude new launches. Verify product-level rules before adding to cart.

Official brand-day preview

Below is the brand-day schedule pulled from Sephora’s Cyber Week preview — treat it as your labeled training data. Add each SKU to your wishlist and tag it with the brand-day label so your execution pipeline knows when to attempt purchase.

| Date | Brands / Deals (example) |

| Thu, 27 Nov 2025 | fresh & Sunday Riley — 30% off (only at Sephora). |

| Fri, 28 Nov 2025 (Black Friday) | Fenty Beauty*, Paula’s Choice & Drunk Elephant — 30% off (*Makeup only). |

| Sat, 29 Nov 2025 | Estée Lauder & Peter Thomas Roth — 30% off. |

| Sun, 30 Nov 2025 | OLEHENRIKSEN, MAKE UP FOR EVER & Ralph Lauren Fragrances — 30% off. |

| Mon, 1 Dec 2025 | Ariana Grande, Youth To The People & First Aid Beauty — 30% off. |

| Tue, 2 Dec 2025 | Too Faced & Bumble and bumble — 30% off. |

| Weekend-wide | Select gifts 50% off across the Black Friday weekend (11/28–11/30). |

Skincare — highest ROI (high information density tokens)

Why: Skincare has a high value-per-mL and long shelf life, so discounts yield strong per-unit ROI.

What to hunt: Full-size serums (retinol, vitamin C, hyaluronic acid), moisturizers, and hero creams. Sunday Riley, Paula’s Choice, Fresh often appear in meaningful brand-day cuts.

Makeup — re-stocks & viral buys

Why: Shade-dependent items sell out quickly; viral items can spike demand.

What to hunt: Cult mascaras, primers, foundations (shade confirmed), and viral lip products. Fenty, Charlotte Tilbury, Urban Decay often appear.

Execution: Confirm shade match before Cyber Week; for must-have shades, treat as priority = 8–10 and perform Greedy checkout the moment the brand window opens.

Hair tools & tech — biggest-ticket steals

Why: Absolute savings on premium tools (hair stylers, high-end dryers) dominate.

What to hunt: Dyson-style stylers, advanced straighteners, and professional-grade devices. If a 20–30% cut appears on a £300 item, this is usually a must-buy.

Execution: Set priority = 9–10 for tools you planned to buy. Use quick checkout (app + saved payment) and don’t rely on restocks.

Fragrances & gift sets — holiday-ready value

Why: Curated sets provide value-added minis and seasonal packaging — excellent gifts.

What to hunt: Holiday fragrance bundles and exclusive gift sets that include minis you’d actually use.

Beauty tech — LED masks & devices (low-frequency but high alpha)

Why: These rarely get meaningful discounts outside Cyber Week.

What to hunt: LED devices, microcurrent tools, sonic cleansers.

Execution: If you’ve been tracking price history and this hits a season-low, lock it in.

European specifics: UK & EU tips, VAT, shipping and returns

Regional promo variance: Sephora UK and Sephora EU run localized landing pages. Deals, GWPs, and brand-day windows may differ. Always shop the local landing page for accurate pricing and promotions.

Currency, VAT & total cost: European prices include VAT. A lower headline price in the US may be negated by shipping, customs, and warranty complications when imported. For most consumers in the UK/EU, local checkout reduces friction for returns and customer support.

Shipping & returns: Shipping thresholds and return windows are often altered during the holidays. Local free-shipping thresholds may be lower during Cyber Week and return windows may be extended for holiday buys — check the local returns policy.

Cross-border buys — when they make sense: Only when the discount is sufficiently deeper to offset shipping, customs, and difficulties with returns/warranty. For exclusive limited edition sets unavailable locally, cross-border purchases may be justified.

Price-checking & restock strategy

Tools & tactics

- Set product alerts: Use Sephora wishlists, “back-in-stock” alerts, and browser extensions that track price changes.

- Follow deal editors: Editors like DealNews and Allure curate winners; they reduce signal-to-noise by highlighting true bargains.

- Check price history: If the tracker shows a season-low or a marked dip in the historical series, move to checkout.

Restock playbook

- If a SKU sells out, enable back-in-stock alerts and add it to your wishlist. Restocks can occur during Cyber Week between brand drops or overnight.

- For hair tools and limited gift sets, restock probability is lower — treat those as high-priority, buy-if-seen items.

How to stack Beauty Insider promotions

Pre-Cyber Week (training phase)

- Create/upgrade your Beauty Insider account and verify contact info. Higher tiers often get early access or extra GWPs.

- Install the Sephora app and sign in; app users commonly get early-bird notifications and app-only gifts.

- Save payment and shipping details securely in your account to reduce checkout latency.

Execution (inference loop)

- Test Promo Codes in your cart early — brand-days sometimes exclude stacking codes.

- Aim for GWP thresholds only if the gift items are beneficial; otherwise avoid spending extra just to hit a threshold.

- Use rewards points where allowed to offset cost — but evaluate opportunity cost (should you save points for a larger future discount?).

Splitting orders & shipping trade-offs

- If GWP thresholds cause wasteful up-sell, consider splitting purchases across days if shipping fees don’t negate savings.

Quick comparison (Sephora UK vs Sephora US vs Ulta) — a softmax of retail channels

| Feature | Sephora UK (2025) | Sephora US (2025) | Ulta (US) |

| Typical discount range | Up to ~25% many brands; some gift sets & tools deeper. | Multi-day brand drops; gift sets often 30–50% off. | Competitive chain; sometimes better on drugstore/points deals. |

| Free shipping | Often lower local threshold (holiday promo). | Historically higher threshold; app & member perks vary. | Store pickup options; points for purchases. |

| Best for | Curated prestige brands & gift sets. | App + Insider is powerful. | Strong competitor for price matching & drugstore. |

Interpretation: Use the channel that minimizes total cost and friction (shipping, returns, authentication). For some items, cross-check Ulta, Amazon, Boots (UK), or brand stores to find the best net price.

What NOT to buy on Black Friday

Avoid these low-expected-value tokens:

- Brand-new launches — often kept at full price or lightly discounted.

- Kits full of minis you won’t use — may seem like value but can be wasteful.

- Indie brands with limited restock — returns can be problematic; buy only if you truly need the item.

Printable Sephora Black Friday Shopping

- Build your top 10-item wishlist and assign a priority (1–10) for each item.

- Cross-reference each item with Sephora’s Cyber Week preview and mark the brand-day.

- Enable back-in-stock alerts for each SKU.

- Install Sephora app and log in to your Beauty Insider account.

- Save payment & delivery info.

- Set browser push notifications from deal editors (DealNews, Allure).

- On brand-day: add to cart then checkout immediately. Don’t rely on “save for later.”

- If sold out: add to wishlist & set back-in-stock alerts.

- Keep screenshots of order confirmations for returns.

- If buying cross-border: check shipping, VAT, and return rules before purchase.

Practical shopping-day workflow

Before Cyber Week (model training)

- Finalize the wishlist and confirm shades & sizes.

- Join Beauty Insider or upgrade as desired.

- Save payment and shipping details for low-latency checkout.

- Add urgent items to cart in advance when possible (some items allow ‘save for later’) and note which day they drop.

24 hours before each brand-day (validation pass)

- Verify the Cyber Week preview and set calendar reminders for brand-days.

- Reconfirm priority for each SKU and update your price target.

On the morning of the brand-day (execution / inference)

- Open the Sephora app and the website.

- Add the item to cart and checkout quickly; app checkout is often faster.

- If a GWP is offered, confirm cart meets the threshold.

- If the item sells out, immediately add to wishlist and enable back-in-stock alerts.

When sold out (fallback policy)

- Add to wishlist & activate back-in-stock alerts.

- Monitor deal editors and restock tweets; set browser alerts for page changes.

- Consider alternatives (other retailers, similar SKUs) if restock probability is low.

Add-on strategies for bigger savings

Stack points / rewards: Use loyalty points if the point redemption value exceeds the marginal saving from holding points for later. Model the effective price after point use.

Split purchases: If a GWP threshold causes wasteful purchases, split the order into two smaller ones — only if shipping costs don’t defeat the benefit.

Compare across retailers: For big-ticket items, check Amazon, Ulta, Boots, and brand stores; sometimes other retailers match or beat Sephora. Use price trackers across these channels.

Payment & checkout hacks (latency reduction):

- Use the Sephora app with saved card details.

- If available, use browser autofill and a fast network.

- Pre-fill address & phone fields to minimize keystrokes during checkout.

Sample wishlist

- Dyson-style hair styler — Tool day (priority 10).

- Sunday Riley serum — Sunday Riley brand-day (priority 9).

- Fragrance holiday set — Fragrance day (priority 8).

- Favorite foundation (shade confirmed) — makeup brand day (priority 9).

- LED device — Cyber Deals if offered (priority 8).

FAQs

A: Sephora runs an extended Cyber Week event; in 2025 Black Friday is on 28 Nov 2025, with brand-day drops across surrounding dates — check Sephora’s Cyber Week preview for the day-by-day schedule.

A: Discounts vary: many brand days fall in the 20–30% range, but gift sets and select tools can reach deeper cuts (historically up to ~50% on select items).

A: Yes — Beauty Insider members and app users frequently receive early access windows and extra GWPs. Join/upgrade before Cyber Week.

A: No — regional pages sometimes have different brand schedules, discounts, and GWPs. Always check your local Sephora landing page.

A: Cyber Monday can extend Cyber Week, but some brand-day exclusives happen on specific dates. Prioritize must-haves on assigned brand-days and watch editorial roundups for Cyber Monday extras.

Conclusion

Sephora Black Friday 2025 is best approached like a Focused Inference Pipeline: gather the canonical data (brand-day preview), tokenize and prioritize your wishlist using a simple scoring model, reduce latency with the app and saved payment methods, and execute with greedy checkout for high-priority tokens. Use back-in-stock alerts, price-history checks, and editor recommendations to reduce noise. For UK/EU shoppers, account for VAT, shipping, and returns in your net benefit calc.